Global feed production is slightly down in 2023. Lower demand attributed in part to more efficient use of feed; poultry feed shows most significant growth.

Alltech’s annual feed survey, now in its 13th year, includes data from 142 countries and more than 27,000 feed mills. By utilizing data gathered by Alltech’s global sales team and working with regional feed associations, it evaluated compound feed production and costs.

Alltech’s annual feed survey, now in its 13th year, includes data from 142 countries and more than 27,000 feed mills. By utilizing data gathered by Alltech’s global sales team and working with regional feed associations, it evaluated compound feed production and costs.

Excerpts from the Agri-Food Outlook 2024:

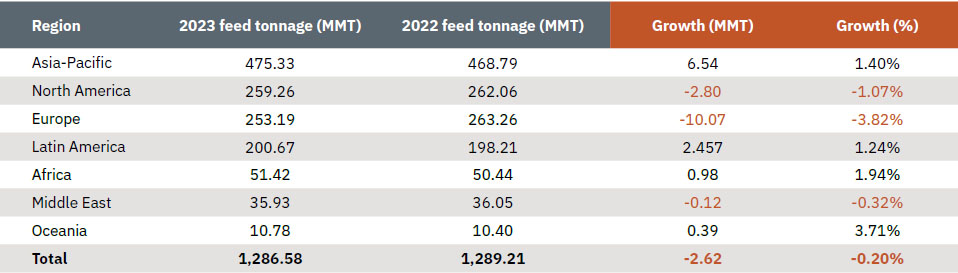

As per Alltech’s Agri- Food Outlook estimates, global feed tonnage totaled 1.29 billion metric tons (BMT) in 2023, a decrease of 2.6 million metric tons (MMT)—or 0.2%—from 2022*.

The overall lower demand for feed was due, in part, to the more efficient use of feed made possible by intensive production systems that focus on using animal nutrition, farm management and other technologies to lower feed intake while producing the same amount of protein, or more. Slower production of animal protein, in response to tight margins experienced by many feed and animal protein companies, also contributed to lower feed demand. The feed tonnage rate — defined as the amount of feed produced and distributed per unit of livestock or poultry — is influenced by multiple factors that affect the demand and supply of feed, as well as the efficiency and profitability of animal production.

Changing consumption patterns caused by inflation and dietary trends, higher production costs and geopolitical tensions also influenced feed production in 2023.

A closer look at the numbers

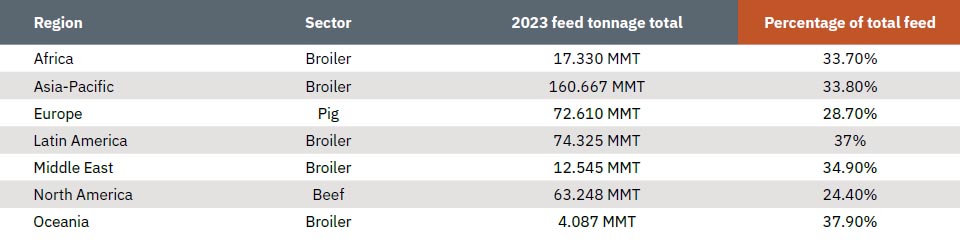

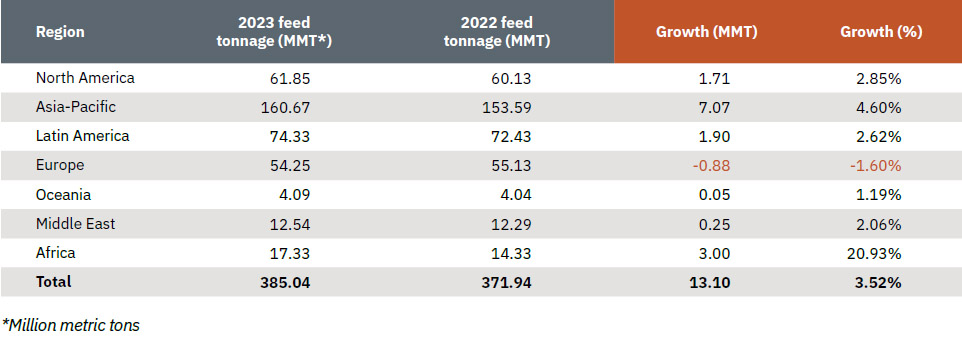

Feed production in 2023 increased in Asia-Pacific by 6.5 MMT (1.4%), Latin America by 2.457 MMT (1.22%), Africa by 1 MMT (1.9%) and Oceania by 0.4 MMT (3.7%), according to feed production data collected for Agri-Food Outlook. Feed production decreased in Europe (-3.8%) and in North America (-1.1%).

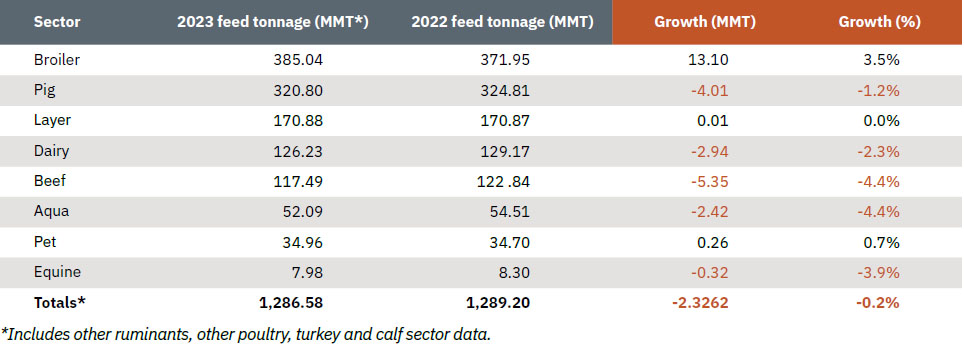

Globally, increases in feed tonnage were reported in the broiler, layer and pet sectors, while decreases were reported in the pig, dairy, beef, aqua and equine sectors.

Overall, poultry feed tonnage continues to expand but at a slower pace — a result of changing consumption behaviour and lower purchasing power. Beef production continues to decline due to changing cattle cycles in the United States and the impact of sustainability regulations in Europe. Aquaculture feed tonnage dropped slightly due to a decline in supply in China. China remains the largest feed-producing country in the world, followed by the United States and Brazil.

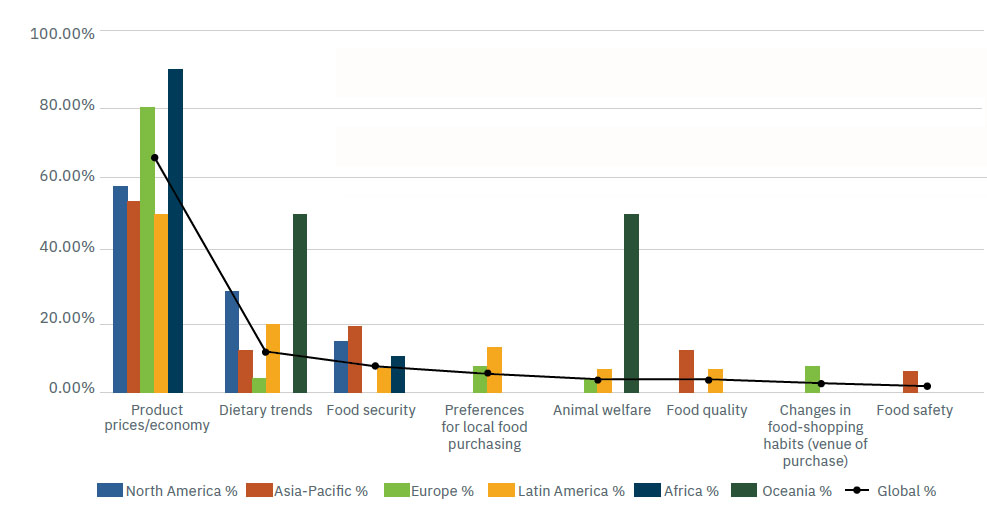

Consumer trends affecting agri-food — by region

According to Agri-Food Outlook survey respondents’, 65% of Alltech Agri-Food Outlook survey respondents rated product prices/the economy as the most important factor influencing feed production. Dietary trends were the distant second-most important factor.

Outlook for 2024

The Alltech Agri-Food Outlook also offers a holistic look at the state of the industry, using answers from our corresponding qualitative survey to uncover the trends and technologies that are impacting the agri-food industry, highlight opportunities for growth and gauge expectations for 2024.

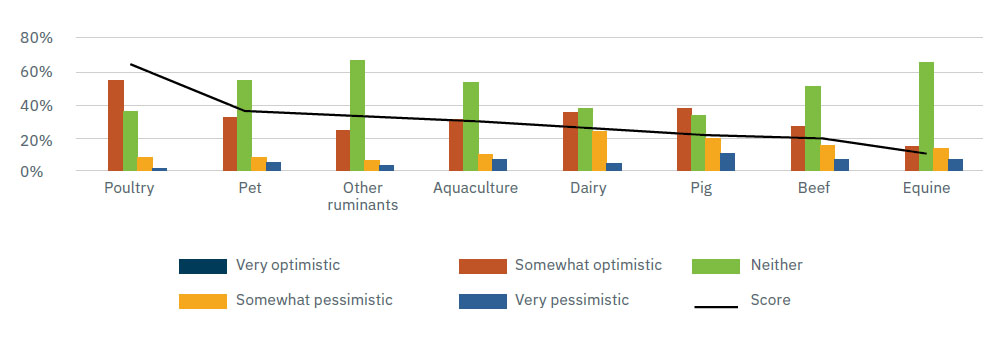

Over half of survey respondents (54.8%) said they were somewhat optimistic about continued growth in the poultry sector. Disease, uncertain economic conditions that affect purchasing power, and shifting consumer dietary trends have all posed challenges to other protein sectors. About 37% said they were somewhat optimistic about growth in pig feed production in 2024, slightly higher than the second-most chosen option of neither optimistic nor pessimistic (32%). Regarding feed production for pets, other ruminants, aquaculture, beef and equine, most respondents said they were neither optimistic nor pessimistic about growth in 2024.

Optimism by sector about future growth

Feed production is expected to grow in 2024, with some market conditions improving as input costs ease and consumers adapt to uncertainties. Production growth is likely to remain robust in Brazil and accelerate in Southeast Asia, with marginal increases expected in China and Oceania.

Latin America is expected to lead production growth in 2024, but at a slower rate than in 2023. Reduced livestock inventories are expected to continue in the United States, lowering feed demand.

2023 Feed Tonnage by Region

This year’s global feed survey estimated that the total global feed tonnage decreased slightly over last year, a .02% decrease of 2.62 million metric tons (MMT) to approximately 1.287 billion metric tons (BMT).

Feed Tonnage by Sector

Volume growth in feed tonnage came predominantly from the broiler feed sector.

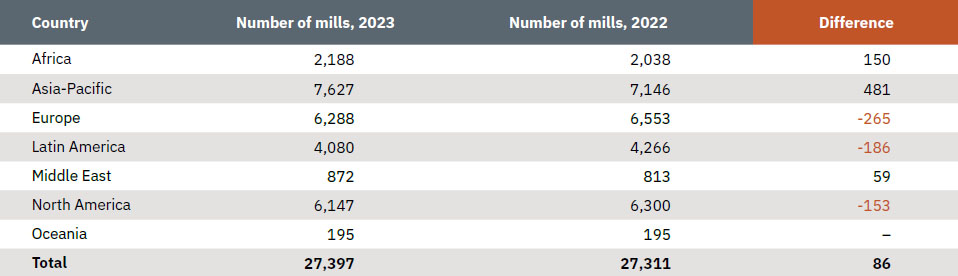

Feed Mills by Region

The multiyear fall in the total number of feed mills in the world was halted in 2023, thanks in large part, to India, where hundreds of additional feed mills were added over the past year. Still, while the total feed mill count is up by 0.3% (or 86 mills), the general trend from the past few years — of larger and, as a result, fewer feed mills — continued in many countries. The number of feed mills declined most significantly in China, Chile, the U.S. and Spain.

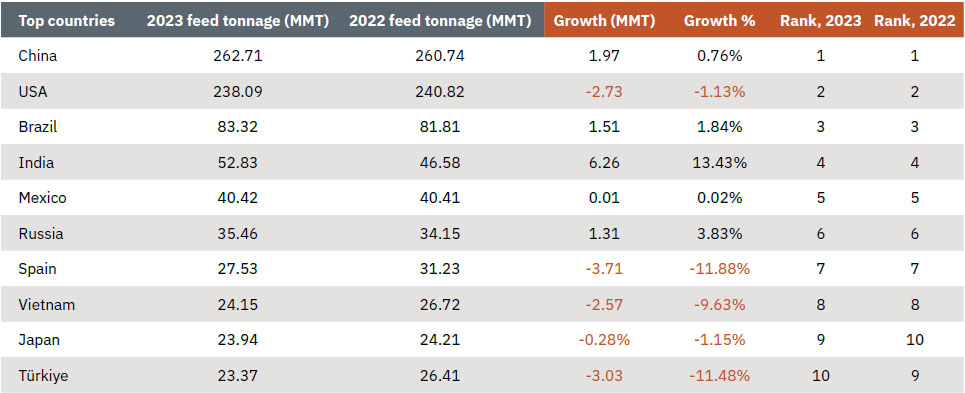

Top 10 Countries

The Top 10 countries in terms of feed tonnage did not change significantly. Türkiye slipped one place, from No. 9 to No. 10, trading places with Japan. Despite significant fluctuations, the other Top 10 countries remained in the same positions.

Altogether, the Top 10 countries used 63.1% of the world’s 2023 feed production, and they can be viewed as an indicator of the trends in agriculture. About 49% of global feed production is concentrated in four countries: China,the U.S., Brazil and India.

Broiler feed now accounts for 29.9% of the total feed tonnage in the world, thanks to a 3.5% increase in overall tonnage in 2023. While this growth was not uniform across all regions, the poultry sector is poised to keep holding strong in 2024 thanks to a combination of regional successes and global market dynamics. Some of the biggest factors that will contribute to the resilience of the broiler sector include reduced costs for inputs, such as feed and energy, and increases in margins and profitability. Shifting consumer preferences will also benefit broiler producers, as inflation and other economic changes often prompt an inclination toward more affordable protein options, and poultry traditionally serves as the preferred choice in those circumstances.

Broiler feed now accounts for 29.9% of the total feed tonnage in the world, thanks to a 3.5% increase in overall tonnage in 2023. While this growth was not uniform across all regions, the poultry sector is poised to keep holding strong in 2024 thanks to a combination of regional successes and global market dynamics. Some of the biggest factors that will contribute to the resilience of the broiler sector include reduced costs for inputs, such as feed and energy, and increases in margins and profitability. Shifting consumer preferences will also benefit broiler producers, as inflation and other economic changes often prompt an inclination toward more affordable protein options, and poultry traditionally serves as the preferred choice in those circumstances.

A closer look

Africa and the Middle East: These regions reported a substantial 12.22% growth in feed production for broilers in 2023, reflecting the resilience and adaptability of the agri-food industry there.

Asia-Pacific: Broiler feed tonnage was up 4.6%, an increase of 7.07 MMT. Animal diseases, such as highly pathogenic avian influenza (HPAI), as well as rising raw material costs and profits that fell short of expectations have all been problems for the region, forcing many smaller operations out of business. Still, optimism for 2024 remains —particularly in Southern Asia, where India saw a 24.57% increase in broiler feed tonnage. The cost of raw materials is also expected to stabilize for broiler producers in Asia-Pacific in 2024.

Europe: Total poultry feed production was down in Europe in 2023 by 0.88 million metric tons (MMT). Many markets were recovering from the impact of avian influenza, while others — including Denmark, Hungary and Portugal —struggled due to a decline in broiler production that led to challenges for local slaughterhouses. Poultry consumption is, however, expected to increase over the next year due to its relatively low price and poultry’s allure as a healthier protein option, and the industry will also benefit from more amenable prices and a rise in imports.

Latin America: Latin America’s poultry industry is thriving, with 2.62% growth (representing 1.89 MMT) in broiler feed production there in 2023. An export-driven market, the Latin American broiler industry has benefited from its highly efficient production and the reduced costs of feeding birds there, which strengthen the region’s competitiveness amongst other poultry-exporting regions around the world.

North America: The North American broiler sector also grew by a respectable 2.85% in 2023. This success was driven by the region’s growing poultry flock, efficient production practices and favourable market conditions and changing consumer preferences.

Oceania: The broiler sector is by far the largest in both Australia’s and New Zealand’s commercial feed industry, comprising nearly 38% of the region’s total feed tonnage. Thanks to this dominance and other factors, the broiler sector grew by more than 1.19%.

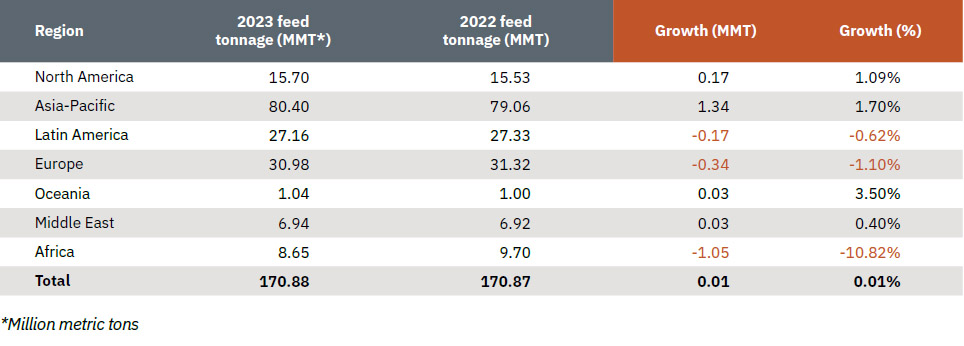

Globally, the poultry feed industry continues to expand, albeit at a slower pace than has been seen at other times. Layer feed tonnage in the region remained unchanged in 2023. There are industry-wide efforts to optimize feed efficiency and keep pace with changing dietary trends and new purchasing power. Macroeconomic difficulties and disease outbreaks, which can disrupt production cycles, had a significant impact on some markets around the world. Still, the general outlook for the layer industry remains positive thanks to its resilience in the face of difficult circumstances, when other protein sectors often struggle to adapt.

Globally, the poultry feed industry continues to expand, albeit at a slower pace than has been seen at other times. Layer feed tonnage in the region remained unchanged in 2023. There are industry-wide efforts to optimize feed efficiency and keep pace with changing dietary trends and new purchasing power. Macroeconomic difficulties and disease outbreaks, which can disrupt production cycles, had a significant impact on some markets around the world. Still, the general outlook for the layer industry remains positive thanks to its resilience in the face of difficult circumstances, when other protein sectors often struggle to adapt.

A closer look

Africa and the Middle East: The layer sector grew marginally in the Middle East but shrank significantly in Africa in 2023. This decline was connected to disease outbreaks — particularly those related to avian influenza, which can set producers back financially while also impacting the overall bird supply.

Asia-Pacific: Despite the previous year’s downward trend, the layer sector rebounded in Asia-Pacific in 2023. Layer feed tonnage grew steadily there, by 1.34 MMT, thanks in part to major increases in countries like India. New layer farms continue to open across the region as consumers turn to poultry as a more affordable protein choice.

Europe: The avian influenza outbreak and other issues had a negative impact on the European layer sector, but producers are optimistic about the coming year because vaccines are being field-tested in various nations. The region’s layer sector was down 1.10%.

Latin America: Layer feed tonnage was down slightly (0.17 MMT, or 0.62%) in Latin America due, in large part, to the effects of highly pathogenic avian influenza (HPAI), which has decimated the region’s bird inventory. Much attention is being paid in particular to Brazil, the world’s largest exporter of poultry, as the presence of HPAI in that country’s commercial layer farms could have ripple effects across the global supply chain.

North America: The North American layer sector saw a 1% increase in feed tonnage this year, which correlated to a similar rise in the number of layer birds in the region. Both of these increases are attributed to changing consumer tastes and preferences.

Oceania: The layer sector grew by 5% in Australia but was down slightly (by 2.86%) in New Zealand.

For a complete report including an outlook on Pigs, Dairy, Beef, Aquaculture, Pets and Equine sector, visit www.alltech.com.

*Last year’s Agri-Food Outlook shared preliminary data that has since been adjusted to reflect final figures, putting total feed tonnage for 2022 at 1.29 BMT. We have refined our resources for retrieving data in several Middle Eastern and Central American countries, revealing higher and more accurate 2022 figures for Algeria, Egypt, Iraq, El Salvador, Panama, Guatemala and Honduras. Feed tonnage for India was also revised significantly. These revisions added tonnage for the layer sector (India and Iraq); broiler sector (El Salvador, Türkiye and Sudan); beef (Egypt and Türkiye); and pig (Panama).

Previous report: Agri-Food Outlook 2023