Sustainability is the catchword of this decade. Every corporation and industry is harbouring steps to be sustainable and compliant. But why has it become the demand of the hour? Because if you are sustainable today, you are working towards a better and promising world tomorrow.

Director – Glamac International Pvt. Ltd

Sustainability and the poultry industry run parallel for a long time. With an ever-growing global demand for quality protein, promoting bird welfare and optimum utilisation and preservation of resources is imperative. Ceaseless innovation, genetic evolution, advanced feed formulation and better animal husbandry practices have helped the poultry industry minimise its environmental footprint and swell sustainability.

Sustainability and the Poultry Industry

There is no alternative for the poultry fraternity but to be ecologically aware and accountable. After all, it takes fertile soil, a healthy farm atmosphere, clean water, and quality feed to produce your most valued protein asset: eggs and meat.

The poultry industry leaves the most negligible environmental impact compared to other animal husbandry industries. For instance, the American poultry sector accounts for only 0.6% of all agriculture-oriented greenhouse gas emissions. In comparison, beef cattle and dairy cattle account for 37% and 11.5%, respectively. Moreover, the entire sector is driven to reduce the Feed Conversion Ratio (FCR) of chickens to boost profitability. FCR means the quantity of feed required in kgs to produce 1kg of chicken. Their diets mainly comprise a combination of soybean and maize and access to a well-formulated feed helps chickens grow faster, requiring less feed. You will be surprised to know that in India, just a decade ago, the FCR, which stood at 1.9, has come down to 1.5 presently. Thus only 1.5kgs of feed is required to produce 1kg of chicken.

Disease-mitigated poultry production backed by lower FCRs is the key to sustainable poultry farming. Technological advancements and nutrition-rich feed curated to meet the feed requirements at each stage of the chicken’s life have reduced the usage of electricity, water, greenhouse gases, farmland and other resources.

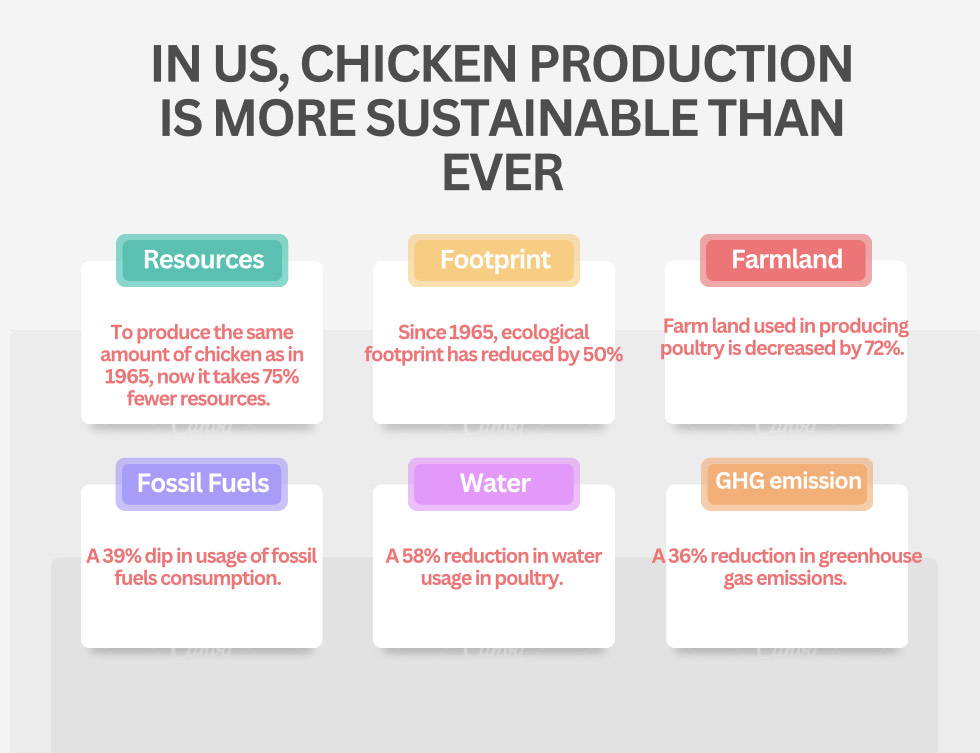

A study conducted by the Department of Biological and Agricultural Engineering at the University of Arkansas revealed fascinating results in the poultry industry’s pursuit of fostering sustainability.

The Role of Poultry Towards Sustainability

Today, the progression of the poultry industry has permitted it to be an affordable staple meal for consumers worldwide. Since it is an integral part of a global food chain, it impacts sustainability in a multi-dimensional framework.

Let’s look at how poultry contributes to environmental, social and governance aspects.

Environmental Impact

1. Water

Water is an essential element in poultry production. Crops for poultry feed (Soybean and Maize) require water, the birds on the farm need water for survival, water is used for maintaining biosafety and sanitisation in the farms, and water also plays a huge role in balancing the farm environment. But, with continuous innovations in the industry, water consumption is significantly easing. Since 1965, the chicken industry curtailed water usage in the US by 58%.

Steps Taken:

- The creation of poultry processing plants facilitated water conservation and reuse.

- Development of apps and technical tools aids in analysing and monitoring water usage in farms.

- Nipple water drinking systems reduce water wastage and spillage on poultry litter.

- Adopting cool cell pads in the farm’s cooling system keeps chickens cool and recycles water.

2. Food

The industry is committed to promoting feed formulations which provide the right nutrients in the right proportion at the right time. Presently, chickens require much lesser feed than they did a decade ago. In 2021, there were 25.8 billion chickens in the world. When you look at the volume, you realise the sector’s significant reduction in food usage. Moreover, earlier antibiotic usage was a necessary component of poultry production. Due to antibiotics, chickens develop resistant bacteria in due time or leave residues which pollute the environment. Multiple countries are taking numerous steps to reduce or eliminate antibiotic usage and switch to natural/phytogenic-based medicines for poultry.

Steps Taken:

- The UK, EU, and Namibia have banned growth-promoting antibiotics in the poultry industry.

- Research is assisting the industry in using plant-based compounds as growth promoters. Many poultry pharmaceutical companies are switching to phytogenics and herbal medicines.

- Nutraceuticals’ utilisation reduces crude protein in poultry diets, boosts protein metabolism, and leads to low ammonia excretion in the environment.

- Emulsifiers reduce oil usage in feed, making it possible to feed poultry low-energy diets without impacting performance.

3. Poultry Litter

Poultry litter is the waste generated by any poultry-rearing system. It can arise from deep litter systems or cage layer waste. It comprises bedding materials (wood savings, rice or peanut hulls), manure, feathers, poultry excreta, etc. If not managed properly, it can be a breeding ground for life-threatening diseases in poultry. However, poultry manure consists of Nitrogen, Zinc, Phosphorus, Potassium, Calcium etc. Thus, with efficient litter management, poultry litter can be a valuable agricultural resource.

Steps Taken:

- Farmers utilise poultry litter as organic fertiliser.

- Poultry litter is a great alternative to fuel and can be used for Biogas /Electricity generation.

- After proper treatment, poultry manure can become a feed for fish and cattle.

- Litter treatments aid in ammonia retention in the litter.

Every step towards poultry welfare in the poultry sector automatically correlates to sustainability. Overall, advancements in the industry are reducing the volume of GHG emissions. Additionally, since every part of the chicken meat converts into utility, there is limited wastage. From chicken feet to feathers, each has its consumption market.

Social Impact

The refined integration of poultry farming in rural and urban rearing systems has left a positive social impact. Yet, many industry stakeholders, like contract farmers, are exploited. Since they often do not receive a fair price for their produce, several governments are trying to bridge the price gap in meat’s journey from farm to table.

1. Gender Parity:

Poultry production is an industry which heavily involves women. From backyard poultry to commercial poultry farming often witnesses substantial women employment.

2. Fair Price for Produce:

Recently, soybean and maize prices witnessed a staggering jump in India, sending poultry farmers into a frenzy. The government facilitated the import of alternative protein sources to stabilise the prices. The country has organisations like Suguna, which started with Suguna Delfrez, providing fresh chicken and eggs sourced from farmers. Such initiatives reduce the dependency on intermediaries and ascertain farmers receive their fair price.

3. Animal Welfare:

The global consumption trend is shifting towards antibiotic-free, organic produce or free-range chickens. Free-range chickens depict better behavioural and physiological patterns and tend to be healthier. Many countries have strict policies to provide adequate space for each bird and do not permit overcrowding on the farm. There are also well-defined policies for overall farm management. It reduces disease load and improves bird welfare. Though many countries are yet to shift due to numerous infrastructural, economic and climactic challenges, ample steps are being taken towards sustainability.

Governance Impact

Accountability and transparency are two pillars of effective governance. Many countries follow a code of conduct with welfare regulations to monitor farm practices. UK’s Animal Welfare Act 2006 mandates animal welfare laws, and a failure to adhere to the guidelines can attract strict penalties.

Furthermore, in India, there is a proliferation of clean teach startups that enable enterprises to meet their sustainability goals and comply. In the Indian government’s pursuit to bolster compliance, it has made EPR (plastic waste management certificate) registration mandatory for industries. In 2021, Canada defined plastic as a toxic substance and banned a ban on single-use plastics. Economies worldwide are progressing towards an economy backed by robust governance and compliance-supported companies.

In A Nutshell

Herbal growth promoters in poultry nutrition are definitely going to have a positive impact on human and environmental health. While India has not been fully able to discontinue the use of AGPs in poultry farming, the shifting trend to a safer alternative has been noticed.

The journey towards sustainability has begun, but the pathway ahead is crooked and entails many challenges. Poultry production has considerably reduced its ecological footprint, but there are multiple innovative ways to improve its role in sustainability. The sector has the potential to become resilient, compliant and profitable if it continues to strive for superior nutrition, safeguard animal welfare and promote advancements in technology.

About The author

Meghana Mukherjee Salvi is a poet, writer and blogger. She likes to study the market, analyse the trends and talk about everything related to Economics.

Bumping into a good book is her guilty pleasure. She is a bibliophile from Bombay living with her husband and exceptional inlaws.

She followed in her father’s footsteps to set her foot in the pharmaceutical industry. Before being a rookie in the poultry industry, Meghana completed her graduation in Mathematics followed by a master’s degree in Economics.

Title Image Source: FreePik

Previous article by author: Challenges To Indian Poultry : What Can Be Done

“It’s very exciting for the Philippines poultry and livestock industry to be part of this globally competitive landscape. This is the opportunity for our stakeholders to become engaged and really take advantage of the technological innovations and advancements as they come and reach our shores. With the promising developments in our national economy, coupled with a growing population. This is our chance to emerge as a stronger, more resilient, more sustainable, and more innovative industry.” said Mr. Jose Gerardo Feliciano, Exhibit chairman of Philippine Poultry Show.

“It’s very exciting for the Philippines poultry and livestock industry to be part of this globally competitive landscape. This is the opportunity for our stakeholders to become engaged and really take advantage of the technological innovations and advancements as they come and reach our shores. With the promising developments in our national economy, coupled with a growing population. This is our chance to emerge as a stronger, more resilient, more sustainable, and more innovative industry.” said Mr. Jose Gerardo Feliciano, Exhibit chairman of Philippine Poultry Show.

leader of the country providing protein-rich foods has always been our prime objective. We are India’s leading poultry group with diversified operations that extend to hatcheries, feed mills, processing plants, animal healthcare products, and nutrition supplements. We are excited to extend our support to the ‘Right to Protein’ initiative and to also adopt the ‘Soy Fed Product’ label that will help highlight the role of high-quality protein feed, such as soy, to improve the protein content of animal-based foods. We believe this initiative will help consumers choose quality animal protein sources and understand the nutritional benefits of the feed to the food. Consumers are increasingly relying on trusted brands like ours for quality and transparency, which motivates us to further reassure them of our commitment to their growing needs.”

leader of the country providing protein-rich foods has always been our prime objective. We are India’s leading poultry group with diversified operations that extend to hatcheries, feed mills, processing plants, animal healthcare products, and nutrition supplements. We are excited to extend our support to the ‘Right to Protein’ initiative and to also adopt the ‘Soy Fed Product’ label that will help highlight the role of high-quality protein feed, such as soy, to improve the protein content of animal-based foods. We believe this initiative will help consumers choose quality animal protein sources and understand the nutritional benefits of the feed to the food. Consumers are increasingly relying on trusted brands like ours for quality and transparency, which motivates us to further reassure them of our commitment to their growing needs.”

Highlighting the booming aquaculture sector in the Philippines

Highlighting the booming aquaculture sector in the Philippines Livestock Philippines is among the series of livestock shows in Southeast Asia organized by Informa Markets. Since 2011, Informa Markets has successfully held Livestock Philippines which has become the official hub of the livestock and poultry sectors in the country as it continuously creates new opportunities for livestock, poultry, and most recently, to work more in aquaculture. For more than a decade, the show has evolved into a centerpiece for markets, buyers, and traders as it has effectively connected the industry’s value chain from the domestic front up to the global scale which significantly helped improve the country’s livestock and feed production.

Livestock Philippines is among the series of livestock shows in Southeast Asia organized by Informa Markets. Since 2011, Informa Markets has successfully held Livestock Philippines which has become the official hub of the livestock and poultry sectors in the country as it continuously creates new opportunities for livestock, poultry, and most recently, to work more in aquaculture. For more than a decade, the show has evolved into a centerpiece for markets, buyers, and traders as it has effectively connected the industry’s value chain from the domestic front up to the global scale which significantly helped improve the country’s livestock and feed production.

At the same time, this is the perfect event to seek out new products, solutions and ideas from leading brands in the livestock, aquaculture and meat processing industries, perfect ways to grow their businesses and increase profits.

At the same time, this is the perfect event to seek out new products, solutions and ideas from leading brands in the livestock, aquaculture and meat processing industries, perfect ways to grow their businesses and increase profits.

Dr. Arindam Chatterjee, the Program Director, commented “Our Vision is to be the pioneer and front-runner in upskilling and re-skilling talent pool into an unmatched industry-ready workforce for new-age animal agriculture towards efficiency and sustainability”. “With this flagship program of Agrivet School has started its journey towards the Vision” Chatterjee puts enthusiastically.

Dr. Arindam Chatterjee, the Program Director, commented “Our Vision is to be the pioneer and front-runner in upskilling and re-skilling talent pool into an unmatched industry-ready workforce for new-age animal agriculture towards efficiency and sustainability”. “With this flagship program of Agrivet School has started its journey towards the Vision” Chatterjee puts enthusiastically.

location, access to onsite business lounges, and pre-arranged onsite business matching meetings. Interested buyers are welcome to contact us at ildex@vnuexhibitionsap.com to apply for this program and to receive more information about the criteria for selection and individual package details.

location, access to onsite business lounges, and pre-arranged onsite business matching meetings. Interested buyers are welcome to contact us at ildex@vnuexhibitionsap.com to apply for this program and to receive more information about the criteria for selection and individual package details.