Mycotoxins- a menace in poultry and way to protect your flock against this challenge

Synopsis: Mycotoxin is continuous challenge in poultry industry, causing ill effects on flock health & productivity Familiarizing oneself with key mycotoxins and implementing strategies such as stringent feed quality control, proactive monitoring, and targeted nutritional interventions are essential to safeguard poultry flocks, ensuring sustained profitability and welfare.

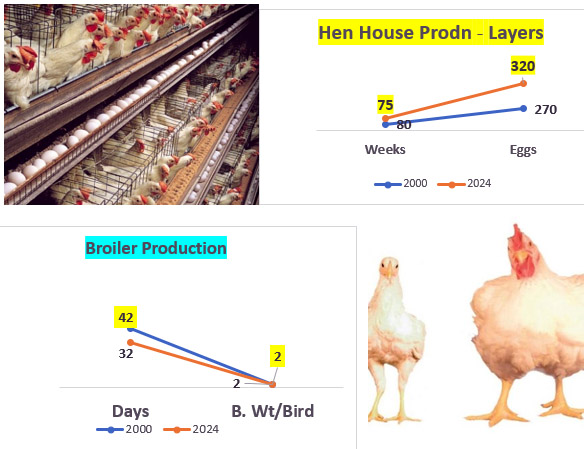

Over the past 50 years, the meat industry has grown remarkably quickly, exceeding population growth by threefold, especially in the production of poultry (FAO, 2013). However, the poultry industry faces significant challenges when it comes to food safety, with the presence of microscopic fungi and mycotoxins posing a threat to both poultry health and human consumers.

Over the past 50 years, the meat industry has grown remarkably quickly, exceeding population growth by threefold, especially in the production of poultry (FAO, 2013). However, the poultry industry faces significant challenges when it comes to food safety, with the presence of microscopic fungi and mycotoxins posing a threat to both poultry health and human consumers.

What exactly are these mycotoxins? These are secondary toxic substances produced by certain fungi that contaminate poultry feed, leading to mycotoxicosis in poultry. This condition encompasses a range of health issues, from growth impairment to mortality. Moreover, mycotoxins can infiltrate the human food chain through poultry products, posing risks to consumers.

Why should we be aware of mycotoxins? Once formed, due to their remarkable stability, mycotoxins persist throughout the feed production process, making prevention challenging, especially in light of factors such as climate variations during crop cycles and inadequate storage conditions in developing nations. Thus, it is necessary to understand the potential dangers associated with mycotoxin contamination as well as the mitigation steps that can be taken to reduce the load of mycotoxin in poultry feed.

Global picture of mycotoxin contamination

- FAO estimates 25% of world grain is mycotoxin-contaminated.

- Top four mycotoxins globally: deoxynivalenol (DON), zearalenone (ZEN), fumonisin (FUM), and aflatoxin (AFL).

- Increased contamination due to high raw material costs, supply chain challenges, and environmental factors.

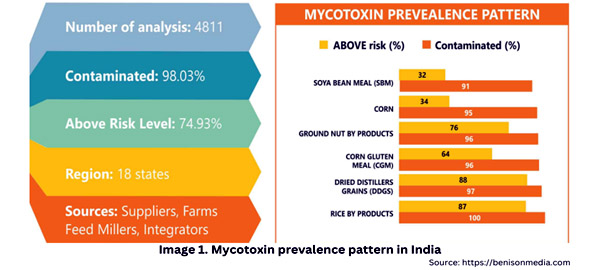

Indian picture of mycotoxin contamination

Indian picture of mycotoxin contamination

• Major concern due to favourable growth environment and poor storage conditions.

• Common mycotoxins in India include aflatoxin, fumonisin, T2 toxin, and zearalenone.

• High percentage of commonly used feed compounds in poultry feed contaminated with at least one mycotoxin.

Understanding Mycotoxins

Mycotoxins are secondary metabolites produced by fungi during stress or environmental stimuli. There are about 200 species of fungi that produce mycotoxins. The majority of the fungi that form mycotoxin belong to three genera: Aspergillus, Penicillium, and Fusarium. Over 500 known mycotoxins produced by these fungi are known, some of which have pathogenic effects and can cause digestive disturbances, feed refusal, lower intake, liver damage, nephritis, immunosuppression, reproductive efficiency impairment, and reduced productivity. Severe cases can lead to high mortality rates. Low levels of prolonged ingestion can be more hazardous than initially thought. It is because of the following key reasons mycotoxins attract attention:

- Once formed, mycotoxins remain stable in feedstuffs throughout harvest, storage, processing, and feeding.

- At the same time, the presence of multiple mycotoxins can be detected; it increases challenge levels, impacting birds’ health.

- Feedstuffs can get contaminated at any stage, i.e., pre-harvest or post-harvest.

- Apart from poultry, it can cause ill effects on consumers of poultry meat and eggs.

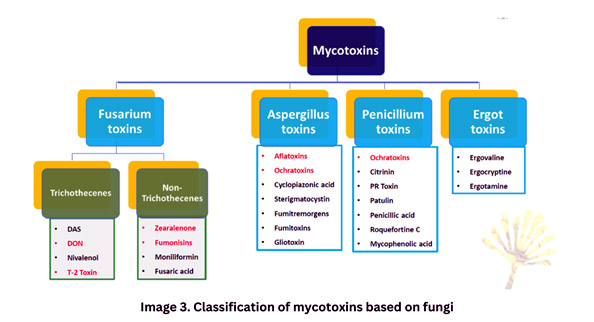

Classifications of mycotoxins

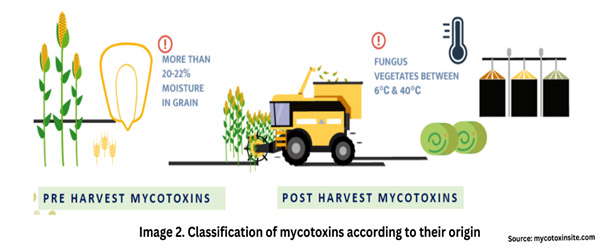

Mycotoxins are commonly classified based on their origin, as below:

- Pre-harvest: They develop before the harvesting period (e.g., deoxynivalenol, zearalenone, fumonisin, and aflatoxin).

- Post-harvest: They develop during the storage period (e.g., ochratoxin and aflatoxin).

The classification of mycotoxins based on the moulds (fungi) that are responsible for their production is given below:

- Fusarium Toxins: Produced by Fusarium fungi, including T-2, DON, fumonisin, and zearalenone.

- Aspergillus Toxins: Produced by Aspergillus fungi, with aflatoxin and ochratoxin most common in poultry feed.

- Penicillium Toxins: Produced by Penicillium fungi, with ochratoxin being the most common in poultry feed.

- Ergot Toxins: Produced by Claviceps purpurea fungi.

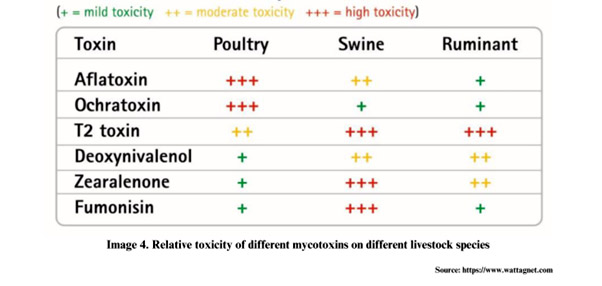

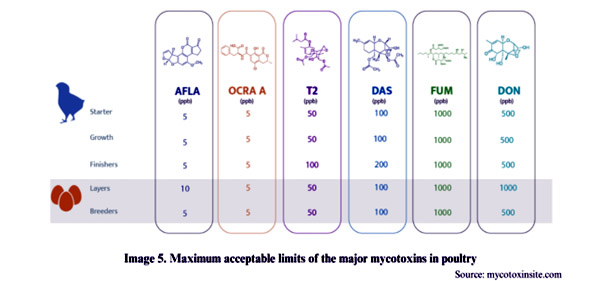

There are a number of mycotoxins produced by several fungi, but not all are harmful to poultry. Particularly, aflatoxin, ochratoxin, trichothecenes (deoxynivalenol, T-2, and DAS), zearalenone, and fumonisin are more prevalent in poultry. Zearalenone is one of the most common mycotoxins found in India; however, poultry seems less affected.

How mycotoxins negatively affect poultry

Mycotoxin causes mycotoxicosis in poultry birds. Then another question comes into your mind: What is meant by mycotoxicosis? Mycotoxicosis is the poisoning that results from the consumption of mycotoxins. Several numbers of mycotoxins affect poultry, with varying degrees of pathogenicity. They can have synergistic effects with other toxins, infectious agents, or nutritional deficiencies. Let’s have a look at the harmful effects of these mycotoxins on poultry in brief.

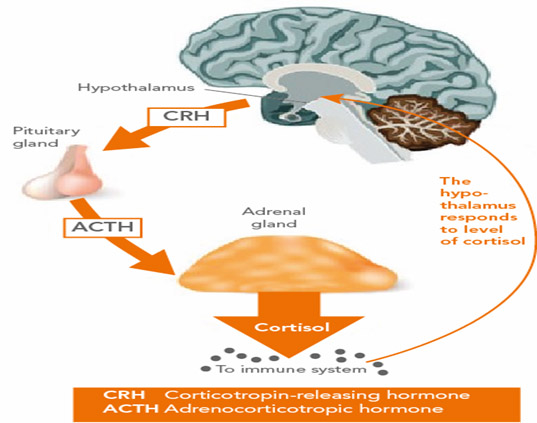

1. Aflatoxin: The toxicity of aflatoxin in poultry is known as aflatoxicosis. Aflatoxin is mainly immunosuppressive. They primarily target the liver, thymus, and bursa in poultry birds. Common harmful effects of poultry are:

- Reduced feed intake and average body weights

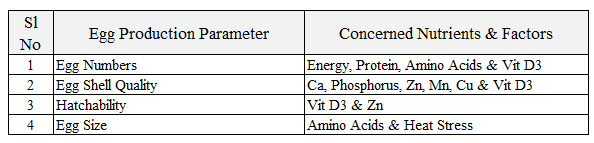

- Deterioration in the production of eggs (layers)

- Decreased hatchability (breeder)

- Hepatic damage

- Increased susceptibility to diseases

- Leg weakness in chicks

- lower vaccination efficacy.

2. Ochratoxin: The main effect produced by ochratoxin is nephrotoxicity, but it can also produce a liver disorder where there is an accumulation of glycogen in hepatic and muscular tissues. The major presumptive diagnosis index of this mycotoxin is pale and enlarged kidney. Ochratoxin can affect the poultry industry in several ways:

- Reduced feed intake

- Depressed growth rate

- Reduction in egg production and poor egg shell quality (layers)

- Gizzard erosion and catarrhal enteritis in young chicks

- Affects nutrient absorption and metabolism

- Acts as an immunosuppressant

- Decreased hatchability (breeder)

3. Trichothecenes: Trichothecenes play an important role in mycotoxicosis in poultry, especially T-2 toxin Deoxynivalenol (DON) and Diacetoxiscripenol (DAS). Trichothecenes toxin harms poultry birds in different ways, such as:

- Visible oral necrosis

- Feed refusal

- Hampered nutrient absorption: reduced performance

- Immuno-suppression

4. Fumonisin: Poultry rations with high levels of fusarium contamination have been associated with

4. Fumonisin: Poultry rations with high levels of fusarium contamination have been associated with

- Reduced body weight gain

- Diarrhoea

- Increased mortality

- Increased weight of the gizzard

How can we detect mycotoxins in poultry feed?

Mycotoxins in feed are frequently identified and measured using chromatographic methods and antibody-based assays.

1. Enzyme-linked immunosorbent assay (ELISA)

- Commonly used, affordable mycotoxin detection test.

- Commercial kits are available for Aflatoxins, Deoxynivalenol, Fumonisins, Ochratoxins, and Zearalenone.

2. Chromatography and spectrometry:

- High-performance liquid chromatography (HPLC) and gas chromatography (GS) are widely used methods for mycotoxin detection.

- HPLC is expensive and requires technical expertise.

- Liquid chromatography combined with LCMS is the gold standard.

How do I control and combat mycotoxins?

Mycotoxins can be present in grains at any stage, from the field to storage, making complete elimination nearly impossible. To manage mycotoxins effectively, mould inhibitors and an effective toxin binder are needed. Incorporating these in poultry feed can protect birds from the harmful effects of mycotoxins and prevent economic losses for poultry producers.

1. Mould inhibitors: To prevent fungal growth, mould inhibitors are added to feeds, but they have no effect on the toxins that have already produced. Organic acids work well as mould inhibitors. Propionic acid, acetic acid, citric acid, sorbic acid, and benzoic acid are the most frequently utilized organic acids. Ammonium hydroxide, essential oil extracts, gentian violet, and oxine copper are further substances that are utilized to lower mycotoxin production.

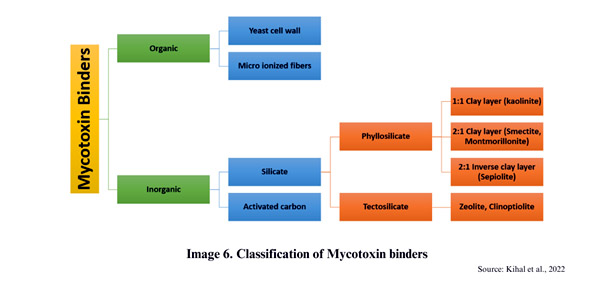

2. Toxin Binders: The best method adopted till date to control mycotoxins in poultry is the use of broad-spectrum toxin binders in the feed. Toxin binders or adsorbents are compounds that bind to mycotoxins and stop them from being absorbed through the gut and into the bloodstream. The use of mycotoxin binders can be beneficial when other preventative measures against fungi and mycotoxins have been failed. In some cases, it might not be possible to routinely check feeds and feed ingredients for mycotoxins. In such situations, a good quality mycotoxin binder can be used as precautions and to provide customers with some level of assurance. There are many substances present with binding capacity towards the mycotoxins. Here you can find some examples of mycotoxin binders as below:

- Activated charcoal

- Aluminosilicate clays: Includes Montmorillonite, Bentonite, Zeolite

- Organic binders: Yeast cell wall and micro ionized fibres

- Synthetic polymers

The most used and most researched mycotoxin-binding agents are the aluminosilicates – clays and zeolites.

Key Considerations in Selecting Mycotoxin Binders

There are few criteria which can help you to know the best mycotoxin binder.

• Broad-spectrum adsorption capacity: An effective mycotoxin binder needs to have the capability to adsorb both polar and non-polar mycotoxins, encompassing both small and large mycotoxins.

• Least active on nutrients: Mycotoxin binders specifically bind the mycotoxins only and should not bind vitamins and micronutrients present in the feed.

• Binding stability: Binding of mycotoxin in the gizzard and even not releasing at neutral or alkaline pH ensures that the complex passes through the intestine and ensures safety for birds.

• Safety: Any binder used in poultry feed should be safe for birds, consumers, and the environment. In simple terms, it means the substance must not be harmful and shouldn’t pass into meat or other poultry products.

• Efficient even at low contamination levels: Sometimes the mycotoxins are present at low levels, but their synergetic effect can cause a potential negative effect on poultry birds. Therefore, mycotoxin binder should be able to adsorb mycotoxins even when their contamination level is low.

Conclusion: Mycotoxin contamination is a major problem in the global poultry business. Under practical conditions, no poultry feed is completely free of mycotoxins. The adverse effects of mycotoxins on poultry are manyfold, indicating a clear and persistent danger. Despite all the efforts made in order to reduce the level of mycotoxins in feed ingredients, there is always a certain degree of contamination that may pose a risk to the animals or birds. The best method adopted to date to mitigate the risk of mycotoxins in poultry feed is the use of a superior toxin binder in the feed.

Authors: Dr. Rahul Mogale (Product Manager), Dr. Sumon Nag Chowdhury (Group Technical Manager), Glamac International Pvt. Ltd.

Image Credit: Glamac International Pvt. Ltd.

Operating under the legal entity Nuqo Animal Nutrition India Pvt Ltd, this strategic expansion marks a significant milestone for NUQO Feed Additives France, reinforcing its presence in one of the largest animal health and nutrition markets globally. The Bangalore office will serve customers across India and the Indian subcontinent.

Operating under the legal entity Nuqo Animal Nutrition India Pvt Ltd, this strategic expansion marks a significant milestone for NUQO Feed Additives France, reinforcing its presence in one of the largest animal health and nutrition markets globally. The Bangalore office will serve customers across India and the Indian subcontinent. Mr. Neeraj Kumar Srivastava, Managing Director of Nuqo Animal Nutrition India Pvt Ltd, stated, “We are excited to unveil our innovative technology and unique solutions to meet the current needs of the market and customers. Our unwavering commitment to pioneering innovation and setting the highest standards in the animal health and nutrition industry is at the forefront of our mission”.

Mr. Neeraj Kumar Srivastava, Managing Director of Nuqo Animal Nutrition India Pvt Ltd, stated, “We are excited to unveil our innovative technology and unique solutions to meet the current needs of the market and customers. Our unwavering commitment to pioneering innovation and setting the highest standards in the animal health and nutrition industry is at the forefront of our mission”.

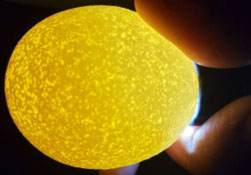

1. Pale Shelled Eggs

1. Pale Shelled Eggs 2. Pink or Liliac Eggs

2. Pink or Liliac Eggs 3. Dirty Eggs

3. Dirty Eggs 4. Shell-less Egg

4. Shell-less Egg 5. Bloody Eggs

5. Bloody Eggs 6. Soft Shell Eggs

6. Soft Shell Eggs 7. Cracked Egg

7. Cracked Egg 8. Corrugated Eggs

8. Corrugated Eggs 9. Wrinkled Eggs

9. Wrinkled Eggs 10. Pimpled Eggs

10. Pimpled Eggs 11. Calcium Coated Eggs

11. Calcium Coated Eggs 12. Mottled Eggs

12. Mottled Eggs 13. Broken or Mended Eggs

13. Broken or Mended Eggs 14. Misshapen Eggs

14. Misshapen Eggs 15. Spots (White Brown speckled) on Egg Shell

15. Spots (White Brown speckled) on Egg Shell