De-commoditising Chicken Meat: Going Beyond Farm gate sales

The Indian poultry industry is one of the fastest-growing segments of the agricultural sector, contributing significantly to the country’s economy and food supply. It has evolved from a backyard activity into a well-organized and industrialized sector, characterized by large-scale, vertically integrated operations.

Serial Entrepreneur, Researcher & Strategic Consultant

dranjangoswami@gmail.com

Mobile: +919449871819

The industry encompasses both broiler meat production and egg production, making India one of the top global producers of poultry products. With advancements in breeding, feed quality, and biosecurity measures, Indian poultry farming has improved productivity and efficiency. Government support, technological integration, and increasing consumer demand for protein-rich diets have further fuelled its growth. The sector is also adapting to trends such as antibiotic-free and organic poultry, reflecting rising consumer health awareness and global market standards. Despite challenges like fluctuating feed costs and disease outbreaks, the Indian poultry industry continues to be a vital component of national food security and rural livelihood.

India’s annual meat production has been estimated at 9 million MT, while egg production surpassed 130 billion units in 2021–22. India’s raw meat exports reached a value of US$3.6 billion in 2023, growing by 12.1% YoY.

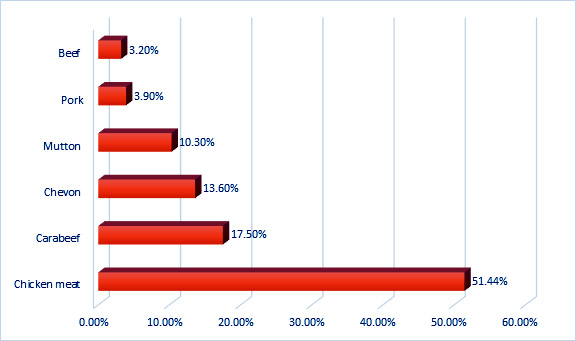

According to the Food and Agriculture Organization’s FAOSTAT production data, India ranks third in egg production and fifth in meat production globally. Poultry has established itself as the fastest-growing meat segment, with a notable 26.8% increase in value during 2017–22, especially due to its affordability and widespread acceptance across various cultures. Poultry accounts for nearly 51.44% of total meat production in India, while buffalo, goat, sheep, pig, and cattle contribute 17.5%, 13.6%, 10.3%, 3.9%, and 3.2%, respectively.

Indian Poultry meat market trend:

The Indian poultry meat market has demonstrated resilience and growth, even as it navigates challenges such as rising feed prices and periodic disease outbreaks. Between 2017 and 2022, poultry meat production experienced a robust growth rate of 31.58%, though 2023 saw a plateau in year-over-year growth due to unexpected factors like avian flu and a significant surge in feed costs. The price of essential feed components, such as maize and soymeal, surged by approximately 35% in 2022 due to supply shortages, impacting overall production costs. Despite these obstacles, consumption of poultry meat is projected to increase, driven by competitive pricing, product consistency, and the nutritional benefits of high protein and low fat. The sector is supported by both organized and unorganized players, contributing 80% and 20%, respectively. Growth in the industry is bolstered by rising incomes, an expanding middle class, and the development of vertically integrated poultry operations that have successfully lowered consumer prices by optimizing production and marketing costs.

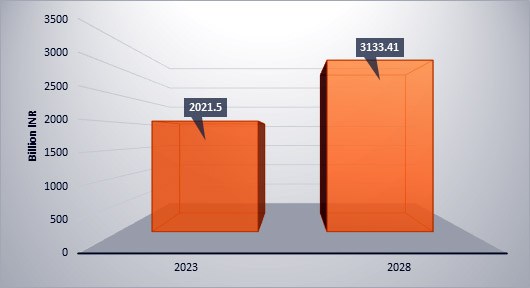

Key trends shaping the future of the industry include a shift from live bird sales to processed and refrigerated products, and policies focused on securing competitively priced corn and soymeal supplies. Additionally, the advancement of high-yield broilers capable of reaching 2.4 to 2.6 kg within six weeks, paired with optimized practices in nutrition, housing, and disease control, has driven an annual broiler production increase of 8% to 10% over the last four decades. While rising feed costs continue to create volatility, the availability of nutrient-rich feeds such as maize, jawar, fish meal, and rice bran is expected to enhance feed conversion ratios, ultimately supporting sustainable growth in the sector. The Indian poultry market is expected to grow at a CAGR of 9.2% in the next 5 years, from present INR 2021.5 billion to INR 3133.41 billion by the year 2028.

Expansion of poultry meat product portfolio by start-ups driving the market:

The Indian poultry meat market is witnessing substantial growth, driven in part by innovative startups expanding their product portfolios and distribution strategies. Companies like Licious, Meatigo, and TenderCuts have transformed the market by offering a wide range of poultry products online, capturing the attention of tech-savvy consumers across the country. FreshToHome, an emerging leader in this sector, now operates in 56 Indian cities, including major metropolitan areas, with over 100 stores and approximately 2 million monthly deliveries. This startup alone accounts for nearly 25,000 tonnes of produce sold annually, showcasing the growing consumer preference for convenient and fresh poultry options. Similarly, Zappfresh, based in Gurugram, offers not only fresh chicken but also ready-to-cook and ready-to-eat variants. The brand processes between 2,000 and 2,500 orders daily, with an average transaction value of around INR 600. This highlights the demand for diverse poultry products, especially through the off-trade channel, which is the fastest-growing distribution avenue in India. This segment is expected to achieve a CAGR of 4.16% in the near future, fueled by consumers’ preference for fresh poultry, bulk buying benefits, and online shopping convenience.

The on-trade channel also plays a pivotal role in the poultry market’s expansion. Between 2018 and 2021, on-trade sales surged by approximately 14%, supported by popular foodservice chains like KFC and Domino’s Pizza, which have diversified their menus to include new meat products. The proliferation of these foodservice outlets is expected to further drive the demand for poultry products, cementing the on-trade channel’s significant contribution to market growth. These dynamics illustrate a vibrant and evolving market landscape where both direct-to-consumer platforms and traditional foodservice providers are fuelling the momentum in the poultry meat industry.

De-commoditisation:

De-commoditisation Refers to the process of transforming a basic, undifferentiated product into a branded or specialized offering that can command a premium price in the market. This shift moves commodities away from price-based competition towards differentiation based on quality, added value, and brand identity. De-commoditising poultry products is necessary to elevate them from being viewed as basic, interchangeable goods to high-value offerings that can command premium prices. This strategic move helps producers differentiate their products through branding, quality assurance, and added features that meet consumer preferences, such as organic certification, antibiotic-free production, and enhanced nutritional value. De-commoditising commodities is a powerful strategy that enables businesses to differentiate their offerings, achieve higher profitability, and build long-term customer relationships by focusing on quality, branding, and value-added features.

Strategies for Decommoditising Commodities: Going beyond farm gate selling

With differentiation, companies can charge a premium price and move away from the low-margin, price-competitive commodity market. Differentiated products foster brand loyalty as consumers develop trust and preference for specific brands or products. Going for a value addition allows farmers to increase their market presence, build direct relationships with consumers, and create a more sustainable and profitable business model. Following are a few suggestive way to add value and de-commoditize chicken meat.

1. Value Addition:

Processing and Packaging: Converting raw agricultural products into processed items, such as turning raw poultry into packaged and marinated chicken products or making eggs into liquid or powdered forms.

Ready-to-Eat and Ready-to-Cook Products: Developing convenient food products caters to the growing market for easy-to-prepare meals, enhancing the value and appeal of the product.

2. Branding and Marketing:

Developing a Unique Brand: Creating a brand that emphasizes quality, sustainability, or specific product attributes (e.g., free-range, antibiotic-free) helps build consumer trust and loyalty. Sharing the farm’s story, sustainability efforts, and ethical practices can resonate with consumers who value transparency and social responsibility.

3. Innovation and Customisation:

Introducing innovative product varieties tailored to specific consumer needs or preferences (e.g., low-fat, high-protein, or gluten-free versions of food products). Offering custom solutions or personalisation options, like packaging sizes for different market segments.

4. Direct-to-Consumer (D2C) Models:

• E-commerce Platforms: Setting up online stores or partnering with existing e-commerce platforms to sell products directly to consumers, ensuring better margins and expanding the customer base.

• Subscription Services: Offering scheduled deliveries of fresh produce or poultry products through subscription models that provide consistent revenue.

5. Collaborations and Partnerships:

• Retail Partnerships: Partnering with supermarkets, grocery chains, and specialty stores helps farmers place their products directly in retail markets, reaching more consumers.

• Restaurants and Food Service Providers: Supplying directly to restaurants, hotels, and catering services can create a steady demand for high-quality, fresh, and specialty poultry products.

6. Niche Markets and Specialty Products:

• Organic and Specialty Products: Focusing on niche markets such as organic, non-GMO, and specialty breeds of poultry can attract health-conscious consumers willing to pay a premium.

• Ethnic and Cultural Products: Developing products tailored to specific cultural or regional tastes can help penetrate new market segments.

7. Cold Chain Infrastructure:

• Investing in Cold Storage and Transport: Ensuring that products maintain their quality during transportation to distant markets is crucial for expanding beyond local sales. Proper cold chain management helps farmers reach urban and even international markets without compromising product integrity.

8. Agri-Tourism and Farm Experiences:

• On-Farm Experiences: Offering tours, educational workshops, or farm-to-table events can create additional revenue streams and promote the farm’s products directly to visitors.

• Workshops and Training: Providing classes on poultry care or sustainable farming practices can attract visitors and establish the farm as an industry leader.

9. Leveraging Technology:

• Mobile Apps and Online Marketplaces: Utilizing technology to list and sell products online, connect with buyers, and manage logistics.

• Blockchain for Traceability: Implementing blockchain technology can enhance transparency and allow consumers to trace the origins of their purchases, which is especially important for high-value and branded products.

10. Export Opportunities:

• Complying with International Standards: Adapting farm practices to meet global safety and quality standards can open doors to international markets.

• Government Schemes and Trade Partnerships: Taking advantage of government support and trade agreements to access new export opportunities.

11.Quality Assurance and Certification:

Emphasizing certifications like organic, fair trade, or non-GMO that resonate with modern consumers. Ensuring consistent quality through rigorous quality control standards, thereby building consumer trust and loyalty.

12. Sustainability and Ethical Practices:

Highlighting sustainable farming practices and fair labour policies, which increasingly influence consumer choices. Decommoditising agricultural products like poultry or maize through eco-friendly practices can position them as premium products in environmentally conscious markets.

Summary:

With rising health awareness, consumers are increasingly seeking high-quality, safe, and nutritious food products. This demand has spurred the implementation of stringent quality control measures and the adoption of modern poultry rearing practices, contributing positively to market growth. The Indian government has actively supported the expansion of the poultry sector through various initiatives and policies designed to encourage investment, offer financial assistance, and promote technology transfer. Unique products often attract niche markets and open up opportunities for expansion into new segments or regions. Consumers are less likely to base their purchasing decisions on price alone, leading to more stable revenues. However, moving beyond farm gate selling may require investments in equipment, technology, and marketing. Expanding reach comes with logistical challenges, including maintaining product quality over long distances.