Synopsis: This article intends to look at the entrepreneurial dynamics of the family-owned businesses especially in relation to the small and medium enterprises in India. It takes an attempt to understand about business dynamics of family own businesses (FBs), the crucial facts about FBs , advantages, challenges and bitter truth about FBs. It also looks at the possibilities of needful steps towards balancing between business entity and family.

The Background: Indian economy comprises of 1000s of small and medium sized enterprises and more than 80% of these enterprises are of family own businesses. Many of those enterprises are managed by the first generation, some of them are by second generations and a few of them are being run by the third generation. Around 90% of all businesses around the world. 70%-90% of global GDP is contributed by the family-owned businesses. Between 50%-80% of jobs in the majority of countries are generated by family-owned businesses and ~ 85% of start-up companies around the world are family-owned businesses.

The global data suggests that there are about ~30% of companies in developed economy & ~ 80% in the growing economy is governed by families respectively.

Indian Poultry Sector: An Overview

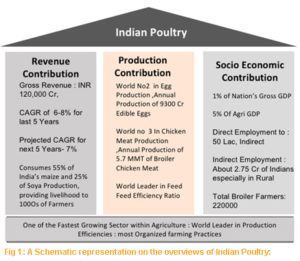

Indian Poultry sector has witnessed a paradigm shift in last few decades and has metamorphosized as one of the most promising industry from a mere backyard farming activity over the years. The Indian Poultry sector is today is ~ INR 120,000 Cr Industry, one of the largest sector within the Agribusiness sector in India. The Industry has grown at a CAGR of 7 % in last 10 years providing direct and indirect employment to more than 5 million Indians producing 5.7 Million of MT of Chicken meat and ~94 Billon of edibles Eggs.

The poultry sector is contributing to 5% of the India’s Agricultural GDP and considered to be having one of the most organised farming practices among all the agriculture produced. The Sector is a star performer and global leader next to brazil in terms of conversion of feed resources to bio-available protein with effectiveness. Indian poultry sector is one of the early adaptor of western concept of contract farming model by sharing resources with farmers. Today 80% of the active farmers Out of total of 220,000 poultry farmers Indian are the under the umbrella of contract farming. The Sector is likely to grow further at an CAGR of 7.5% for next 5 years as per the industry estimation with the ongoing shift in consumer behaviour in term of converting from carb based food to protein reach diet.

The future trend in India Poultry in relation to enterprise management

The perspective of business dynamics of Family-owned businesses is highly relevant to Indian Poultry Sector. ~95% of the poultry sector enterprises in India are driven by the family members. Although there are a few examples of appointing professionals and designing board structure but apparently the control of the businesses and related decisions has always been with the family members.

Family Own Businesses (FBs)- Definition: Broadly the family-owned businesses can be defined as follows:

- A business where multiple members of the same family are involved or control the business as major owners or managers. A business governed and/or managed with the intention to shape and/or pursue the vision of the business held by a dominant coalition controlled by members of the same family or a small number of families.

- A business where the decision-making rights are in the possession of the person(s) or family who established the firm, or the person(s) or family who has/have acquired the share capital of the firm. A business where the person who established or acquired the firm or their families possess 25% of the decision-making rights mandated by their share of capital (European Union definition 2009).

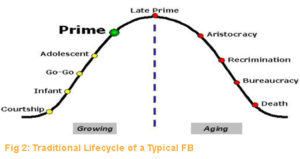

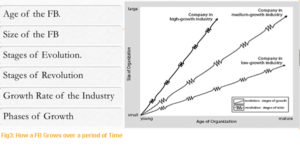

Growth phases of the Family own Businesses:

A family-owned business grows over the years in different dimensions. A FB grows as its age and size of the business increases. The growth in the FB are also determined by its stages of evolution and revolutions. The industry growth rate and market forces also determine the phases of the growth of a FB.

Salient Features of the Family own Businesses:

- FBs have higher profitability in the long run

- FBs are Resilient and more focused

- FBs are financially more prudent

- FBs have a more long-term outlook than Short term growth

- FBs are more likely to look after the community

Positive aspects of FBs:

- Well known family name, building credibility and trust helping the businesses to grow

- Strong shared values

- Long-term perspective not solely aiming to please the shareholders

- Informal structure facilitating agility in decision making

- Deep understanding of the business and the market

- Close ties with government (especially in emerging markets)

- Easier access to local resources (especially in emerging markets)

Hard facts about FBs:

- Research has shown that globally less than 30% of family businesses are successfully passed to the second generation, and less than 10% are successfully transferred to the third. The first generation builds the company, the second preserves it and the third squanders it” “It is only but three generations from shirtsleeves to shirtsleeves.”

Balancing the wagon wheel: Balance between families and businesses

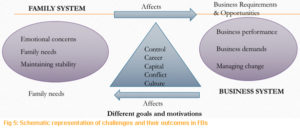

The family-owned businesses often find it difficult to balance between the family system and business requirements & opportunities. The emotional concerns and family needs adversely affect the business performances and business demands. The outcome of the difference between the family and the business witnesses a diversion from the core competencies, goals and motivation.

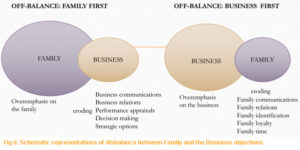

The disbalance between the core value of the family and the businesses in the family-owned businesses impact both the family and he businesses adversely. There have been incidences of over emphasis on family concerns over the business objectives eroding the business communication and relations impacting the decision marking and strategic options of the company. On the other hand, in some of the family own businesses, there is overemphasis on the business’s objectives affecting the family communication, relations, family identifications and loyalty.

Challenges in FBs:

The issues in the family-owned businesses can broadly be categorized in relation to:

A. Issues related to the management of the business

B. Issues related to the management of family relations: The founder and the family dynamics

A. Issues related to the management of the business

- Lack of common vision and shared values

- Lack of Clears Roles with accountability

- Lack of planning for growth- Poor Self and Time management

- Lack of necessary financial resources

- Misalignment of strategies

- Misfit in organizational structures

- Un scalability

- Problems in decision making

- Lack of proper governance systems

- Fear of Conflict

- Poor next generation leadership skill development

- Issues in attracting and retaining talent

- Weak HR systems

B. Issues related to the founder:

- Reason for building this business

- The relationship with the business

- Rivalry with outsiders and other family members

Issues related to the family dynamics:

- Inadequate experience of family members

- High risk aversion

- Succession planning

- Family conflicts

- Problems in decision making

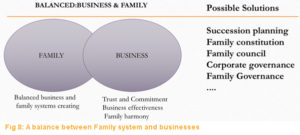

- Governance

A balanced business and family systems with a methodical succession planning, formulation of a family constitution, family council and a fair family governance is key to the successful transition of a family-owned business.

About the author:

Dr. Anjan Goswami, Director in R J Feeds Pvt Ltd, and Navjeevan Hatcheries Pvt Ltd. have got over thirteen years of Enterprise management experience in the Poultry and Food Sector across all the verticals. He has been instrumental in innovating and implementing different types of revenue and investment sharing models which are being adopted by different companies in the sector.

Dr. Anjan has mentored and co-founded enterprises in the Health and Service sector. He is the present General Secretary of Karnataka Poultry Farmers’ and Breeders’ Association (KPFBA). Dr. Anjan brings exposure in the areas of Business Management strategy, financial analysis, investment advisory, due diligence, and corporate restructuring of businesses and has experience of successfully closing overseas M&A deals. The Equity, Debt investments, Joint Ventures, and M&A Agreements have been his area of expertise as well.

Dr. Anjan is a Doctoral Research Fellow at ISB Hyderabad, holds an MBA from the Indian Institute of Management, Bangalore. Apart from being a M.V.Sc, his academic exposure also includes advanced business management training from “Capsim Management Simulation Inc” USA and studies on rural sociology under the program “understanding rural India” from Azim Premji University, Bangalore.

Thanks for posting. Great insights

Fantastic Dr.Anjon.

Your insight clear my idea,vision its give me tremendous feeling of confidence & personal power.

Tnx a lot.

Dr.Chinmoy

DVM(Bangladesh)