Alltech Agri-Food Outlook 2023 data shows global feed production remained almost steady in 2022, with a decrease of only 0.42% compared to the 2021 estimates.

Alltech 2023 Agri-Food Outlook survey, now in its 12th year, includes data from 142 countries and more than 28,000 feed mills. It assesses compound feed production and prices by utilizing information collected by Alltech’s global sales team and in partnership with local feed associations.

Alltech 2023 Agri-Food Outlook survey, now in its 12th year, includes data from 142 countries and more than 28,000 feed mills. It assesses compound feed production and prices by utilizing information collected by Alltech’s global sales team and in partnership with local feed associations.

Excerpts of the Agri-Food Outlook 2023:

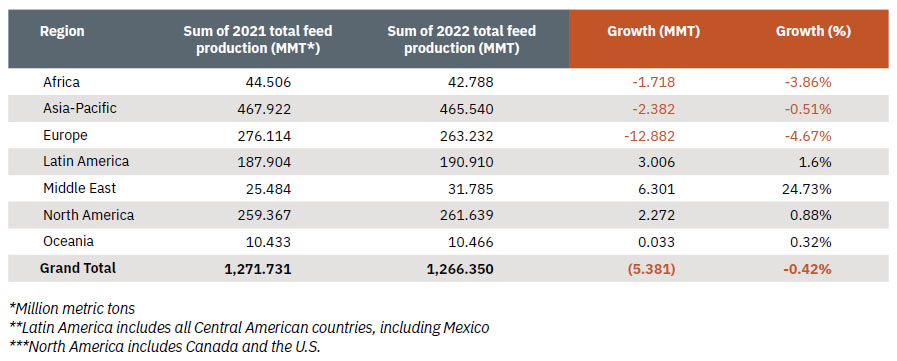

As per the Agri-Food Outlook 2023, the global feed production remained steady in 2022 despite significant macroeconomic challenges that affected the entire supply chain. Europe bore the brunt of the impact, including significant disease challenges, severe weather and the impacts of the invasion of Ukraine. Alltech’s Agri-Food Outlook estimates that global feed tonnage totalled 1.266 billion metric tons (BMT) in 2022, a decrease of less than one-half of one percent from 2021’s estimates.

Feed production increased in several regions, including Latin America (1.6%), North America (0.88%) and Oceania (0.32%). As a result of improvements in the scale and accuracy of our sources in the Middle East, our 2022 feed production numbers were nearly 25% higher than they were in 2021. The Middle East increase is also due in part to an initiative by the Saudi Arabian government to expand broiler chicken production to meet the country’s self-sufficiency goals.

Feed production in Europe decreased by 4.67% and was down by 3.86% in Africa. Production in the Asia-Pacific region also dropped 0.51%.

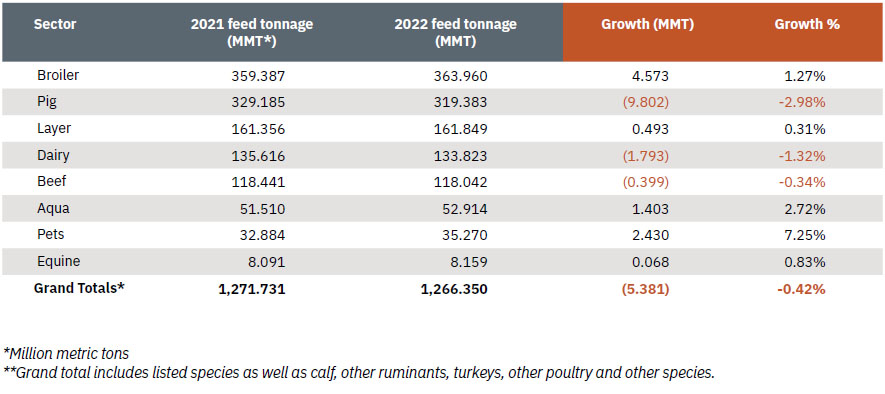

Globally, increases in feed tonnage were reported in the aquaculture, broiler, layer and pet food sectors, while decreases were reported in the beef, dairy and pig sectors.

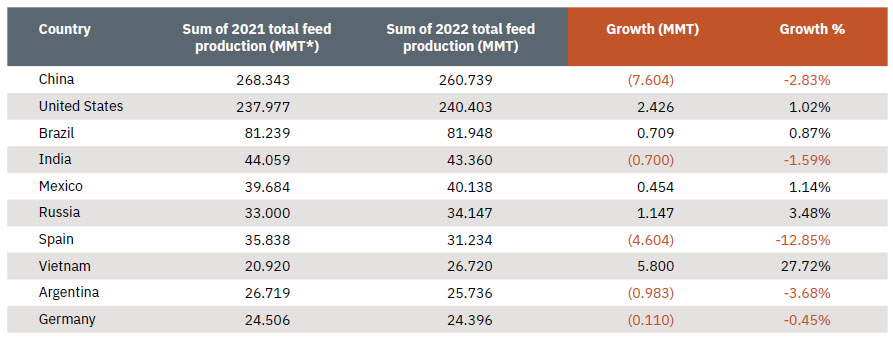

Although it experienced a narrow reduction in feed production, China remains the largest feed-producing country in the world, followed by the United States and Brazil.

The role of technology

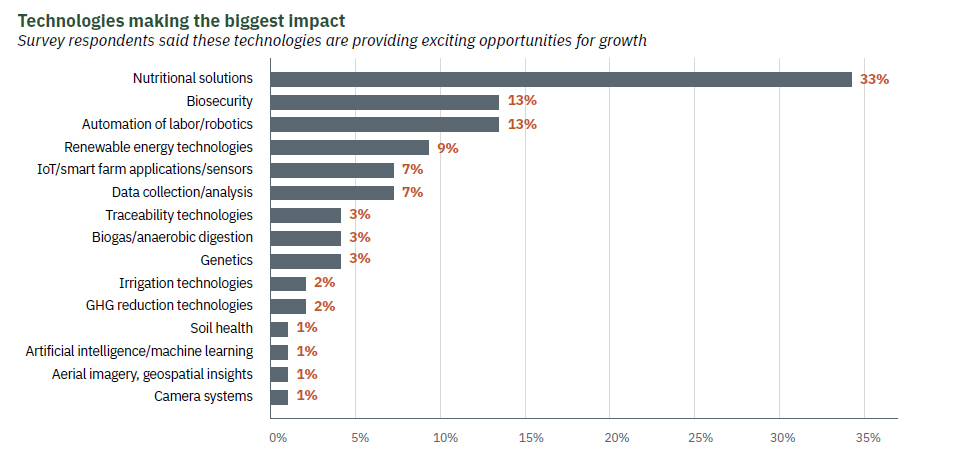

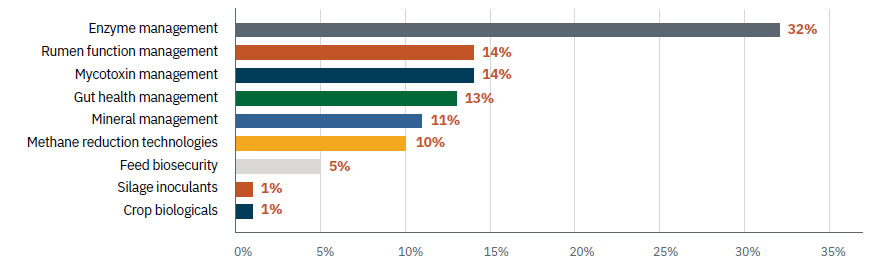

A variety of technologies are providing growth opportunities for the agri-food industry, survey respondents said. Among the technologies making the biggest impact are nutritional solutions, biosecurity and the automation of labour/robotics. Of nutritional solutions, respondents noted enzymes (32%), technologies impacting rumen function (14%) and the management of mycotoxins (14%) as being the most significant to their market.

The use of enzymes to improve the digestibility of nutrients, decrease the cost of production and reduce the environmental impact of agriculture are having a significant positive impact, said one respondent from Spain.

The use of enzymes to improve the digestibility of nutrients, decrease the cost of production and reduce the environmental impact of agriculture are having a significant positive impact, said one respondent from Spain.

Innovative technologies that increase efficiency and improve sustainability were cited by many participants as being highly promising and important.

Top nutritional opportunities

Survey respondents said these nutritional solutions are most pertinent to feed production in their region

Top challenges to feed production*

Survey respondents identified the biggest ag-related challenges in their country

Biggest challenges

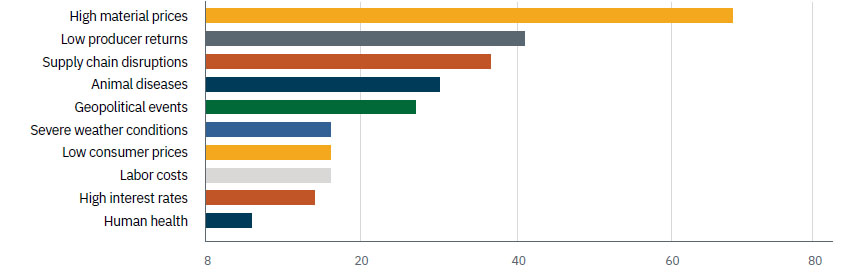

Inflation and the overall state of the economy — particularly the increased prices of raw materials, feed and food — have been the biggest challenges affecting the agri-food sector in 2022, respondents said.

“Due to the (COVID-19) epidemic, consumers’ behaviour has changed significantly and continuously, and they have taken a more proactive approach to health,” said a survey respondent from China.

Supply chain disruptions remain an obstacle for the agrifood industry across all regions.

Many regions reported that geopolitical tensions —particularly the invasion of Ukraine — have affected imports and exports, the supply chain and raw materials prices.

The direct impact of the war was reported in Moldova and in Ukraine, where feed production fell by over 35%. The invasion of Ukraine also indirectly affected feed production throughout the rest of the world.

Disease disruptions

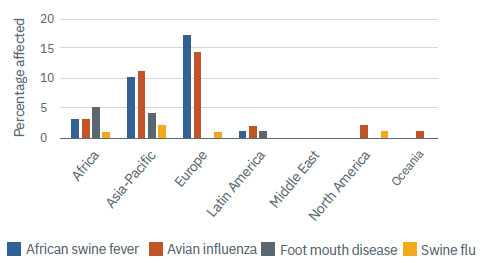

Animal diseases have disrupted feed production in more than 80% of countries.

Avian influenza affected all regions’ feed production in 2022. In Africa, this disease manifested most significantly in Egypt, Morocco and South Africa. In Asia, nearly all countries were affected. In Europe, the affected countries included Belgium, Bosnia and Herzegovina, Bulgaria, France, Ireland, Moldova, the Netherlands, Poland, Russia, Serbia, Turkey, the U.K. and Ukraine.

In Europe, African swine fever (ASF) has most significantly affected Ireland and countries in the East. In the Americas, the Dominican Republic was affected most significantly. In Asia, ASF has played a significant role in China, Indonesia, Malaysia, Myanmar, Nepal, the Philippines, Singapore, South Korea, Thailand and Vietnam. In Africa, Kenya, Mozambique and Namibia were affected.

Foot and mouth disease (FMD) was an issue in Africa, particularly in Egypt, Mozambique, Namibia and South Africa. In Asia, Indonesia, Mongolia, South Korea and Thailand were affected. Finally, in the Americas, FMD was an issue in Bolivia.

Swine flu was an issue in Namibia, China, Myanmar, Belgium and the U.S.

Overall, Latin America and the Middle East did not report many instances of disruption due to animal diseases.

Sustainability insights

Efforts to improve environmental sustainability are impacting the feed/animal agriculture sector in most regions, survey respondents said. The majority of respondents said sustainability efforts are being driven by the government (50% of respondents), food producers and processors (47.27%), consumers (44.74%) and retailers/ food service companies (39.47%).

The top sustainability measures being implemented include reducing antibiotic usage and antimicrobial resistance (AMR), improving animal welfare, producing food more efficiently, reducing water pollution, creating renewable energy, reducing greenhouse gas emissions, and enhancing nutritional value and food security.

Survey respondents said that some of the biggest aggregated opportunities are new technologies like smart-farm applications, increasing efficiency, incorporating more nutritional solutions and continuing to make efforts to become more sustainable.

AGRI-FOOD OBSERVATIONS

Animal diseases have disrupted feed production in more than 80% of reporting countries.

Feed tonnage by region

Based on data collected in November 2022, Alltech estimates that the total global feed tonnage in 2022 decreased slightly — by 5.381 million metric tons (MT), or 0.42% — to approximately 1.266 billion MT.

The survey showed a 3.86% decrease in feed tonnage in Africa, mainly because of reductions reported in Egypt, Morocco, Kenya and Nigeria. South Africa, on the other hand, saw an increase of more than 2%, and Namibia also reported higher feed tonnage in 2022.

The Asia-Pacific region was flat. Reductions in China, Pakistan, Thailand and Malaysia were offset by increases reported by Vietnam, the Philippines, Mongolia and South Korea. Despite the challenges faced there, Vietnam has been a growth market for feed in Asia.

The biggest retreat in feed tonnage was seen in Europe, where it was down nearly 5%, or over 12 million metric tons (MMT). Some of the primary factors for this decreased production include the invasion in Ukraine and the spread of animal diseases, such as ASF and avian influenza.

Among the big four regions, Latin America came out on top this year as the winner in terms of growth in feed tonnage, with an increase of over 3 MMT. Most of this growth was reported by Mexico, Brazil and Chile.

2022 expectations: 59% of Alltech Agri-Food Outlook respondents said feed production in their region met their expectations

The Middle East region is also up significantly, as a result of more accurate reporting and efforts by the Saudi Arabian government to increase broiler production as part of its Vision 2030 plan.

North America (the U.S. and Canada) reported an increase of more than 2.4 MMT (all in the U.S.). Growth was reported in the broiler, beef and pet food sectors.

The region of Oceania was flat, with a small reduction reported by Australia that was offset by a slight increase reported by New Zealand.

The majority of respondents, 59%, said that feed production in their country met their expectations in 2022. Feed tonnage fell below expectations for 28% of survey respondents and exceeded expectations for 13%.

Looking ahead, over half of respondents (52.5%) said they are optimistic that feed production in their country will grow in 2023.

Top 10 countries

Together, the top 10 countries consume 64% of the world’s feed, and half of the world’s global feed consumption is concentrated in four countries: China, the U.S., Brazil and India.

Vietnam experienced a great recovery in terms of its feed tonnage in 2022, entering the top 10 ahead of Argentina and Germany and crowding out Turkey, which reported reduced feed tonnage. Russia overtook Spain, where there was a significant reduction in feed production.

Feed production estimates by sector

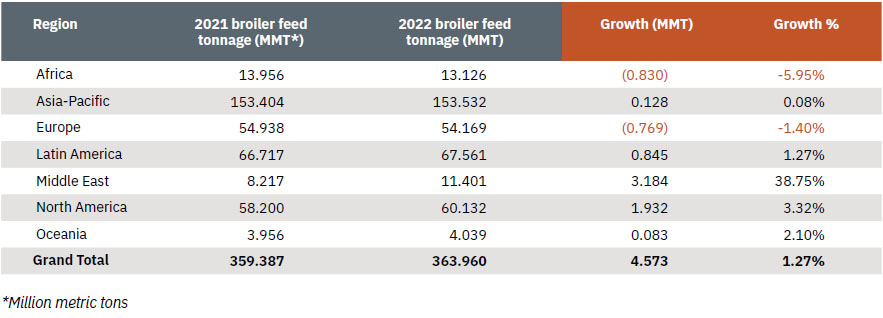

Globally, feed tonnage increased in the broiler, layer, aquaculture and pet food sectors. Volume growth in feed tonnage came predominantly from the broiler feed sector.

Percentage wise, the biggest growth was in pet food. The pig, dairy and beef sector experienced decreased feed tonnage.

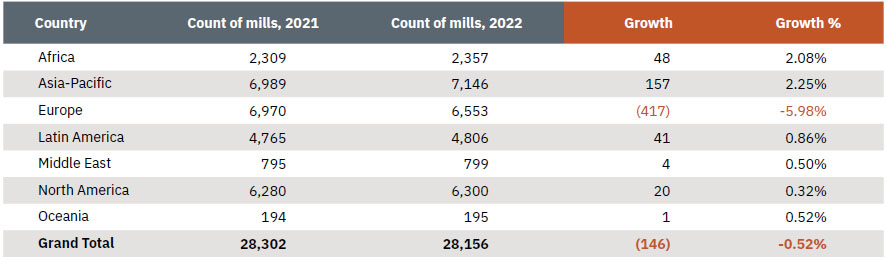

Feed mills

As consolidation continues, the number of feed mills continues to decrease and output by large feed mills continues to rise. The number of total feed mills in 2022 was down slightly, about one half of one percent, from 2021.

The biggest reductions in feed mill numbers were seen in Europe, specifically in Spain, Poland, Ukraine, Russia and Hungary. Feed mill numbers in some African countries (Ghana, Mozambique and Namibia) were previously underreported, when only the largest feed mills were included in the survey.

While the overall tonnage in the broiler sector increased by about 1.3%, there were significant differences from country to country. Overall, feed production growth in the broiler sector was reported mainly from the Middle East, North America and Latin America.

While the overall tonnage in the broiler sector increased by about 1.3%, there were significant differences from country to country. Overall, feed production growth in the broiler sector was reported mainly from the Middle East, North America and Latin America.

Global poultry markets are expected to stay strong in 2023 but may have some price and volume swings depending on the region.

A closer look

Africa: There were increases in broiler feed tonnage in some countries, but those were offset by a big reduction in Kenya, where feed production dropped over 44%.

Asia-Pacific: Broiler feed production decreased in China but increased in Vietnam. In China, production was affected by low market demands and high raw materials prices. In India, higher broiler feed prices continue to challenge the industry’s margins and limit capacity growth. Avian influenza affected India, Japan, Korea and Vietnam.Feed production in the Philippines increased significantly, due to a switch from pig farming to broilers because of African swine fever (ASF).

Europe: Poultry production in Europe was significantly affected by avian influenza and the high price of raw materials and energy.

Latin America: Brazil and Mexico, which represent most of the market for broilers in Latin America, had steady numbers from 2021 to 2022.

Middle East: In Saudi Arabia, local broiler production is expanding to lower the country’s dependence on chick imports.

North America: Broiler feed production was up over 3% and broiler exports were flat. Broiler production is growing slowly each year and will most likely continue at this pace.

Oceania: Feed production was up over 2%.

AGRI-FOOD OBSERVATIONS

The broiler sector had the highest global feed production, with nearly 364 million metric tons.

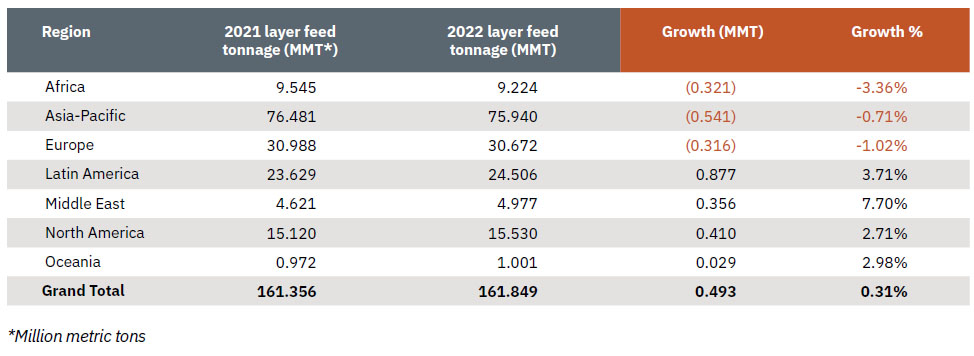

Avian influenza, other diseases and the high costs of raw materials affected the layer sector in many markets, especially in Asia, Europe and Africa. On the other hand, growth in the sector was boosted due to bigger challenges in other sectors that led to increased demand for eggs.

Avian influenza, other diseases and the high costs of raw materials affected the layer sector in many markets, especially in Asia, Europe and Africa. On the other hand, growth in the sector was boosted due to bigger challenges in other sectors that led to increased demand for eggs.

Overall, layer-sector feed production increased by just one-third of 1%.

In areas hit by avian influenza, the availability of breeding stock has been tight, restricting production growth and expansion. Disease, macroeconomic headwinds and long periods of high input costs are limiting poultry growth worldwide.

A closer look

Africa: Kenya reported a 42.5% (0.3 MMT) reduction in layer feed tonnage because of high production costs. Over 40 layer producers have closed their operations there in recent months.

Asia-Pacific: Although the 2022 price for eggs was relatively high in China, the feed material cost (maize and soybean meal) was prohibitive to layer production. The number of laying hens in stock in 2022 decreased significantly compared with 2021. Layer feed tonnage was down 3%, or a reduction of 1 MMT. In the Philippines, layer feed production increased by 0.734 MMT — or 28% —because ASF prompted conversions from swine production to layer and broiler farms. India reported an 8% decrease in layer feed tonnage because many small layer farms shut down.

Europe: Europe witnessed a tight poultry market with a strong price. Poultry production is expected to drop, keeping prices high, because of ongoing avian influenza pressure and high input cost. For UK poultry, declining self-sufficiency is expected to continue in 2023, with a slight increase in imports from the Netherlands, Poland and Thailand.

Latin America: Feed value increased because countries such as Argentina increased egg production. In Brazil, the rise of the raw materials prices and the slow increase of final prices put the egg industry in a difficult situation. Demand was slower and prices were higher. In 2021, there was a decrease in the number of breeders, which continued to affect the industry in 2022, but a recovery is expected by the end of 2023.

Middle East: Feed production increased nearly 8%.

North America: Layers were more affected by avian influenza than any other poultry species in the U.S in 2022. More than 57 million commercial birds in the U.S. were affected, mostly layers and turkeys.

Oceania: Layer feed production climbed nearly 3%, with nearly every country increasing in feed tonnage.

Pigs: Globally, feed production was down in 2022 by almost 3%. African swine fever (ASF) and high feed prices depressed pig production in many countries. However, in Vietnam, China, South Africa, Brazil and Mexico, better pork prices and other market conditions led to growth in the sector.

Dairy: In most countries, there was a decline in commercial feed production for dairy, mainly due to the high cost of feed combined with low milk prices, which caused farmers to reduce their numbers of cows and/or rely more on non-commercial feed sources. Some exceptions included Ireland, where drought caused farmers to rely more on commercial feeds, and New Zealand, where milk prices were higher. In total, we saw about 1.32% less compound feed produced in the global dairy sector.

Beef: The trend toward a reduction in beef feed production appears to have slowed, with feed production down only 0.34% in 2022. The downward trend continued in Europe, but increases were seen in almost all other regions. In Australia, the reduction in feed tonnage was a result of plentiful grass and not a reflection of any changes in the demand for beef.

Growth in 2023 is expected in China, Brazil and Australia, while decreases are anticipated in the U.S., Canada and in countries throughout Europe.

Aquaculture: The aquaculture sector experienced a total global feed production growth of 2.7%. The top 5 aquaculture feed countries are China, Vietnam, India, Norway and Indonesia. Significant increases were reported in China, Brazil, Ecuador, the Philippines and the U.S. The aquaculture sector was one of a few sectors up in Europe, where large decreases in feed production were reported.

Pets: Of all of the species’ sectors measured in the Agri-Food Outlook survey, the pet food sector — which increased by 7.25% — had the most significant growth. It was up even in Europe, the region that dipped most in 2022 feed production.

Equine: The equine sector increased by 0.83%, growing in all regions except Latin America. It displayed the highest growth in Asia-Pacific and Oceania.

For complete details of the report, visit www.alltech.com

The survey showed that, regionally, COVID-19 had varying effects. Some regions, such as Africa, cited more challenges than others, and in many cases, this was a country-by-country determination. The rise of e-commerce was seen around the world and is expected to be ongoing for food purchasing in the future.

The survey showed that, regionally, COVID-19 had varying effects. Some regions, such as Africa, cited more challenges than others, and in many cases, this was a country-by-country determination. The rise of e-commerce was seen around the world and is expected to be ongoing for food purchasing in the future.

Poultry meat and eggs are generally considered universal foods. Some industry challenges arose from the widespread shutting down of restaurants. Disease, such as avian influenza, was also a concern and remained a challenge for many in the business. However, offsetting any declines in feed production due to these challenges was an increased interest in eggs as an inexpensive protein, particularly for those in economically suppressed areas.

Poultry meat and eggs are generally considered universal foods. Some industry challenges arose from the widespread shutting down of restaurants. Disease, such as avian influenza, was also a concern and remained a challenge for many in the business. However, offsetting any declines in feed production due to these challenges was an increased interest in eggs as an inexpensive protein, particularly for those in economically suppressed areas.